Provisional Tax Dates Calendar

Use the widget below to view the corresponding payment dates for provisional tax and terminal tax based on your balance date.

Display payment dates based on paying provisional tax* in instalments:

Taxpayers using the standard or estimation method who file their GST returns every six months will pay their provisional tax in two instalments.

This is the default option for taxpayers using the standard or estimation method.

Taxpayers using the GST ratio method will pay their provisional tax in six instalments.

Provisional tax dates*

28 August

First instalment

15 January

Second instalment

7 May

Third instalment

Terminal tax*

7 February

Without extension of time

23 April

Cutoff

7 April

With extension of time

21 June

Cutoff

Alternatively, get in contact via the details below

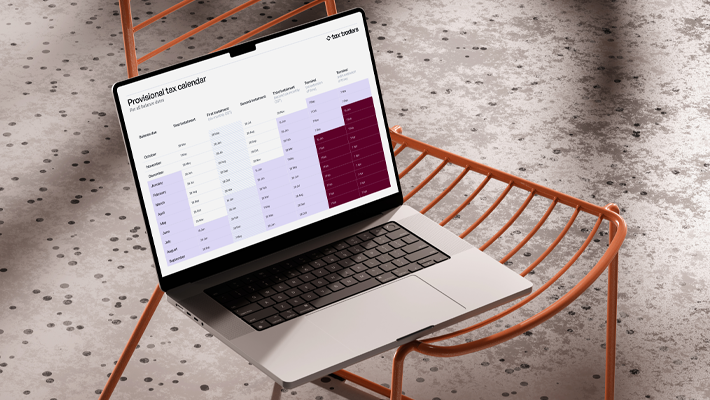

Provisional tax calendar for all balance dates

View and download a provisional tax calendar for all balance dates, providing an overview of payment dates throughout the tax year.

Download PDF

Better results for you and your clients

- Our team of experts is here to help. No problem is too big or too small.

- An industry-leading platform to improve your efficiency.

- Training and support to help you get the best out of tax pooling for clients.

How we help

We provide you with a smarter way to work. Our end-to-end platform helps you unlock greater provisional tax productivity and deliver added value for your clients with payment options that work for them.

Who we are

We are a fintech founded on the belief that the benefits of tax pooling should be available to all taxpayers and that business can be a force for good. Our team is inspired to solve complex problems and make the world a better place.