{"header_color":"creme","show_form_in_footer":"yes","type":"module"}

Pay later

Get startedIf your client is short on cash to pay their provisional tax on time, Tax Traders provides a way to defer their payment for up to 22 months.

This enables your client to avoid late payment penalties and reduces the interest cost they pay.

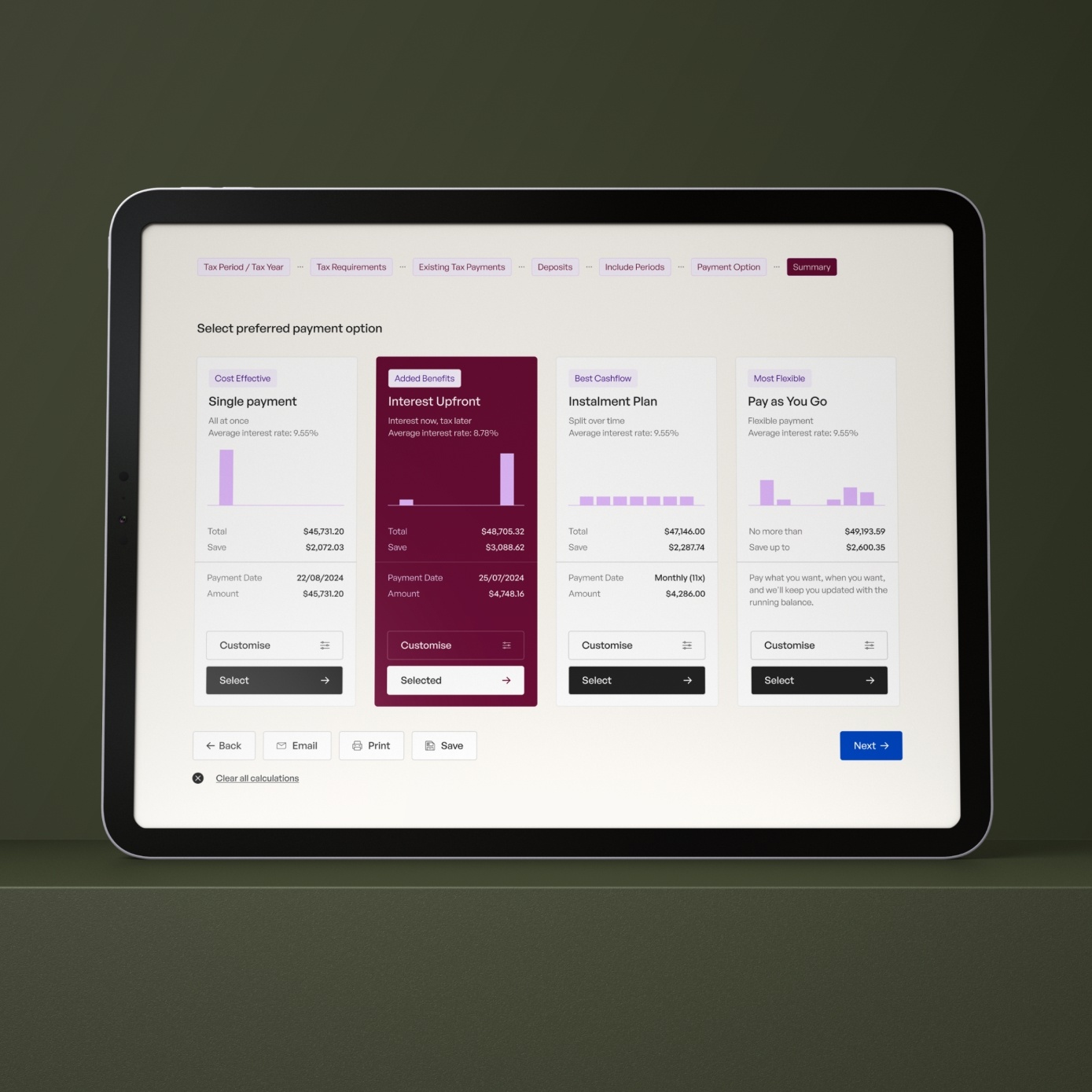

Payment options:

1. Split payment – interest upfront and tax later. This allows you to secure a significantly lower interest rate for your client as the arrangement is put in place ahead of an upcoming provisional tax date.

2. Single payment – pay tax and interest all at once.

Key information

- Only income tax can be settled in this manner for an initial assessment.

- Your client has up to 75 days past their terminal tax date to pay the provisional or terminal tax they owe for a given tax year.

How it works

On each provisional tax date, Tax Traders pays tax into its Inland Revenue account. These payments are date-stamped when they are paid.

Tax will be applied by Tax Traders against your client’s liability at Inland Revenue whenever they make a payment towards their instalment plan.

This will continue to happen until your client’s arrangement with Tax Traders has been paid in full.

-

Split payment - interest upfront and tax later

1. Your client pays Tax Traders the interest amount ahead of their upcoming provisional tax date. The interest amount is based on the tax amount they need and the date in the future they would like to pay.

2. Your client then pays Tax Traders their tax at the agreed future date. Tax Traders arranges for the date-stamped tax amount to be transferred from our Inland Revenue account to your client’s Inland Revenue account.

3. Inland Revenue recognises that your client has paid on time once it processes this transfer, removing interest and late payment penalties showing on your client’s account. -

Single payment – pay tax and interest all at once

1. Your client pays the tax amount owed, plus our interest cost to Tax Traders.

2. Tax Traders arranges for the date-stamped tax amount your client needs to be transferred from our Inland Revenue account to your client’s Inland Revenue account

3. Inland Revenue recognises it as if your client has paid on time once it processes this transfer, removing interest and late payment penalties showing on your client’s account.

Why Tax Traders

- Up to 22 months for your client to pay

- Fully customisable payment options to suit your client’s cash flow or other business priorities

- Reduce your client’s interest cost and eliminate late payment penalties

- Payment amounts and frequency can easily be changed online, at any time

- World-class service

- Training and support

Get started today

-

Approved by Inland Revenue

-

Public Trust holds and approves all payments and transactions

-

Money back guarantee if Inland Revenue declines your request