{"header_color":"creme","show_form_in_footer":"yes","type":"module"}

Finalise Tax

Get startedOur residual income tax (RIT) calculator makes optimising a client’s tax position faster and easier than ever.

You no longer need to determine how much tax your client needs at each provisional tax date. The calculator automatically details any Tax Traders transactions needed, and provides payment options that you can present to your client so they can satisfy their liability in the most economical way possible.

And when used in conjunction with our IR data connectivity tool, you’ll be able to save even more time.

Key information

- When swapping a tax deposit, you are selling the surplus tax credits at one date and purchasing tax credits at the correct date. The swapped funds become purchased funds as a result and can only be used to satisfy income tax obligations for current periods.

- Purchased tax must be completed and transferred to Inland Revenue within 75 days of your client’s terminal tax date.

How it works

-

1

Enter the following into the RIT calculator for the tax year concerned:

-

Your client’s RIT

-

Specific payment amounts

-

Any payments made to, or credits in, your client’s Inland Revenue account

-

-

2

The RIT tool takes into account any transfers from Tax Traders for settled tax pooling arrangements, as well as any tax pooling arrangements on invoice (with the option to exclude these from the final calculation). It will also recognise any deposits with Tax Traders, allowing you to select which ones are utilised. If there are deposit surpluses, you can determine how you would like these applied.

-

3

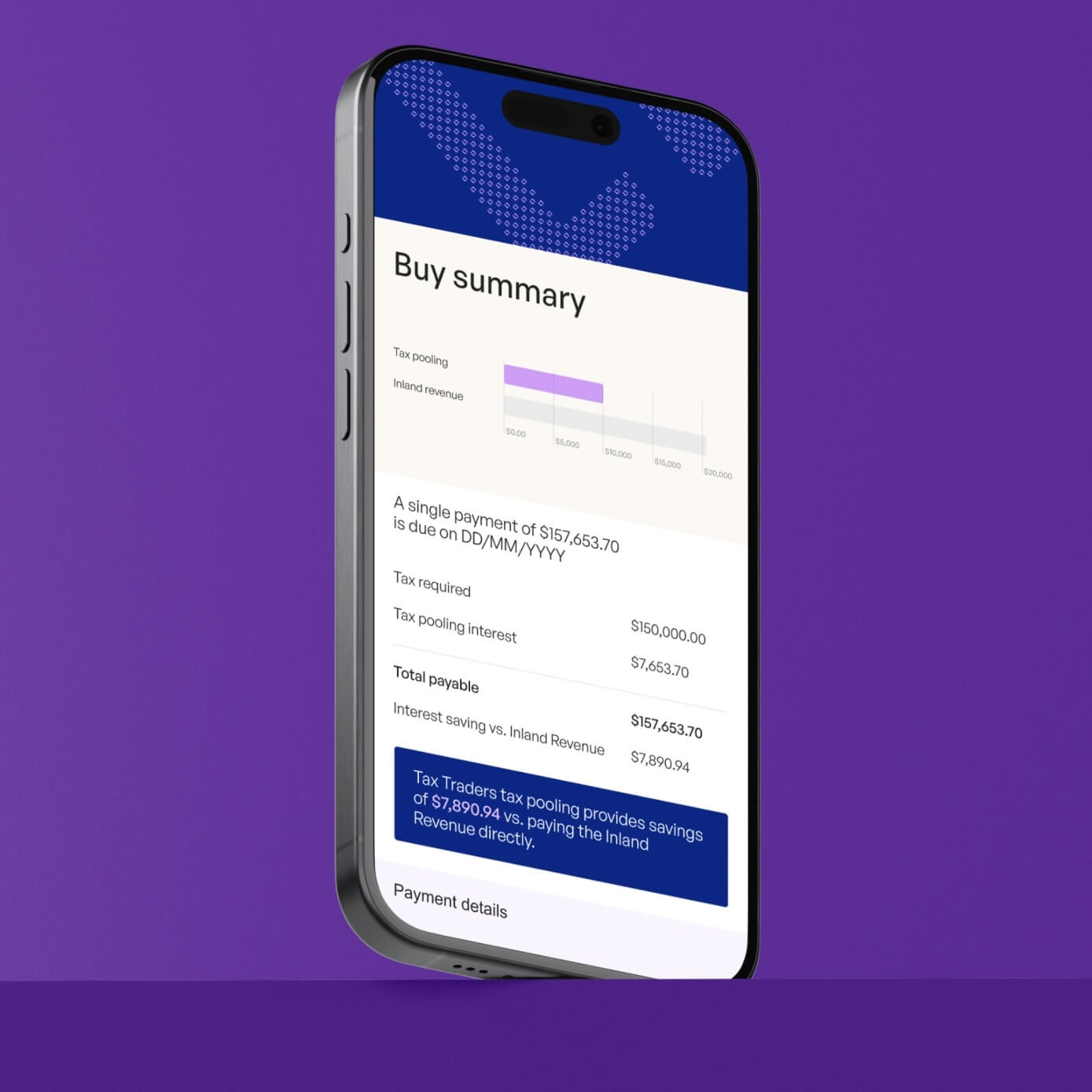

The RIT Summary will specify the tax required at each provisional date and funds will be apportioned accordingly. If there are shortfalls, the necessary tax purchases will be automatically calculated, so you can select the payment option that best suits your client.

Why Tax Traders

- Ensures amounts transferred to Inland Revenue are the correct amount and at the correct date - we stand behind our calculators

- Eliminates Inland Revenue interest and late payment penalties

- Completes swaps automatically online – quickly, efficiently and accurately

- All debit and credit interest are removed, leaving your client with a single easy payment

- World-class service

- Training and support

Get started today

-

Approved by Inland Revenue

-

Public Trust holds and approves all payments and transactions

-

Money back guarantee if Inland Revenue declines your request