Pay now

Get startedAre you an accountant looking for greater control and flexibility over a client’s provisional tax payments than Inland Revenue offers? Would you like to add considerable value if their tax for the year has been underestimated or overestimated?

If so, then talk to your client about making their payments into Tax Traders' account at Inland Revenue if they have funds available on their provisional tax dates.

There is no downside to ‘depositing’ – just access to a range of options that are otherwise not available if your client pays Inland Revenue directly.

Key information

- Tax Traders’ account at Inland Revenue is overseen by Public Trust.

- Deposits held by your client can be used to secure affordable working capital.

- While depositing into Tax Traders’ account at Inland Revenue is for provisional and terminal tax, your client’s payments can be applied to other tax types (subject to certain criteria).

- Any changes to your client’s deposits must be completed and transferred to Inland Revenue within 75 days of their terminal tax date.

- Deposits made by your client can be refunded at any time (subject to your client completing AML requirements), without the need for you to file a return.

Access funding without the usual hassle

By depositing their provisional tax payments into Tax Traders’ tax pool account, your clients unlock the option to use their tax deposits as security to access affordable working capital if their cash flow gets tight via our sibling company, Taxi.

Find out more

How it works

-

1

Provisional tax payments made by your client to Tax Traders are date stamped when they are paid and held in our account at Inland Revenue.

-

2

Once you have confirmed your client’s residual income tax (RIT) for the year, you have the following options if they have underpaid or overpaid for the year:

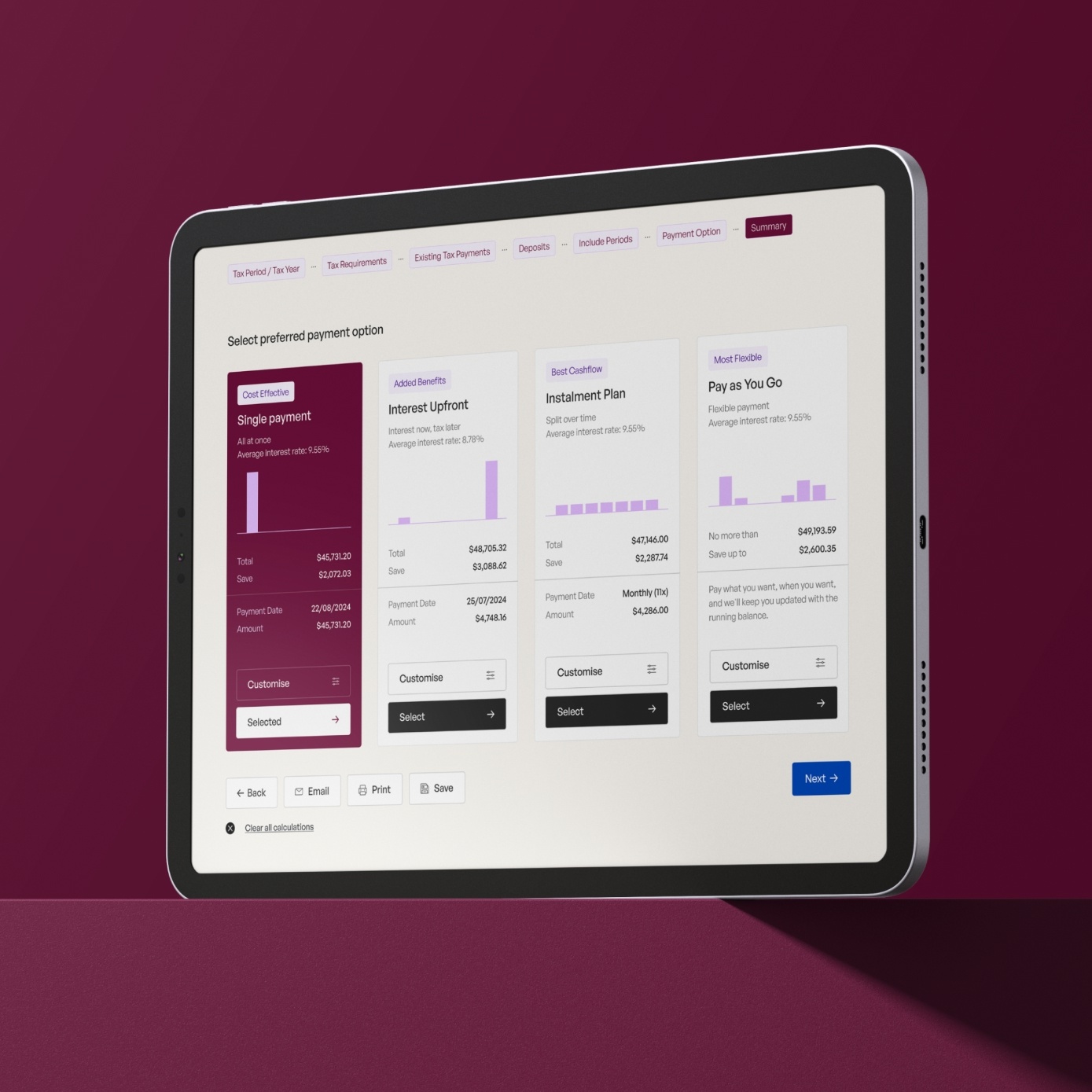

Swap: Move a client’s tax payments forwards or backwards between their provisional tax dates to either reduce the interest amount they need to pay or increase the interest amount they receive. This transaction can be performed online, allowing you to create the perfect payment profile for your client in a matter of minutes.

Buy: Top up any provisional tax shortfalls for the year to reduce the interest amount your client needs to pay and remove any late payment penalties.

Sell: Increase the interest amount your client receives if they have paid too much provisional tax for the year. Your client would be selling their excess tax to someone else who has underpaid. AML documentation required.

Refund: This lets you secure a refund of any tax overpaid by your client. Your client will receive Inland Revenue credit interest. -

3

Once you know what your client requires at each date for the year to satisfy their RIT, Tax Traders will arrange for your client’s payments to be transferred from our Inland Revenue account to your client’s Inland Revenue account. Inland Revenue will treat this as if your client paid on time once it processes these transfers, removing interest and late payment penalties showing on your client’s account.

Why Tax Traders

- No minimum amount to deposit

- No account fees or set-up costs

- Online account to manage your client’s tax balances at any time

- Associated entities included in a single account

- Ability for you to earn your client premium interest on overpaid tax and reduce the interest they need to pay on underpaid tax

- Get faster refunds for your client

Get started today

-

Approved by Inland Revenue

-

Public Trust holds and approves all payments and transactions

-

Money back guarantee if Inland Revenue declines your request