In August 2022, we published an article on how tax pooling can be used to satisfy a backdated liability where there is no prior existing assessment/return filed.

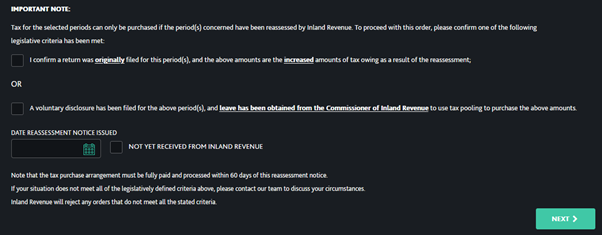

Once leave has been obtained from the Commissioner of Inland Revenue to use tax pooling in these circumstances, you can purchase tax via our portal online. The only additional step you need to take is to tick the checkbox ‘A voluntary disclosure has been filed for the above period(s), and leave has been obtained from the Commissioner of Inland Revenue to use tax pooling to purchase the above amounts’, as below:

Need help?

The team is on hand to assist with any questions or queries you may have regarding tax pooling. Please phone us on 0800 829 872 or email team@taxtraders.co.nz and we will be happy to help

Head to the knowledge base to find out to use our tool to use tax pooling for incorrectly filed taxes.